Worried about overfunding a 529? Would a taxable account be better for college savings? I built a calculator to help you decide.

- bryanjepson

- Jul 4, 2025

- 3 min read

Updated: Oct 14, 2025

My last few blog posts have been all about saving for the rising cost of college education. First was a post about how to figure out how much you will need to save. The second post was about the various savings options. This post is a little bit different and will try to address the question: What happens if I have saved all this money in a 529 account and my child doesn’t end up using it?

As a quick review, a 529 account is a state-administered college savings account where you can choose between a small group of investment options similar to a 401(k) account. The money grows tax-free and is distributed tax-free as long as it used on a qualified educational expense (tuition, fees, books, room and board, etc). The account remains the asset of the individual who creates it (usually a parent) but is intended for the use of a designated beneficiary. If you use the money on non-qualified (non-educational) expenses, you have to pay ordinary income tax on the growth and an additional 10% penalty.

It is because of that penalty and the higher tax rate (compared with capital gains taxes) that many people ask the question that I posed above. Is a 529 worth it? Wouldn’t it be better to just earmark a taxable brokerage account for my child’s education and if they end up not using it, then I would still have the flexibility to spend it on whatever I want without penalty?

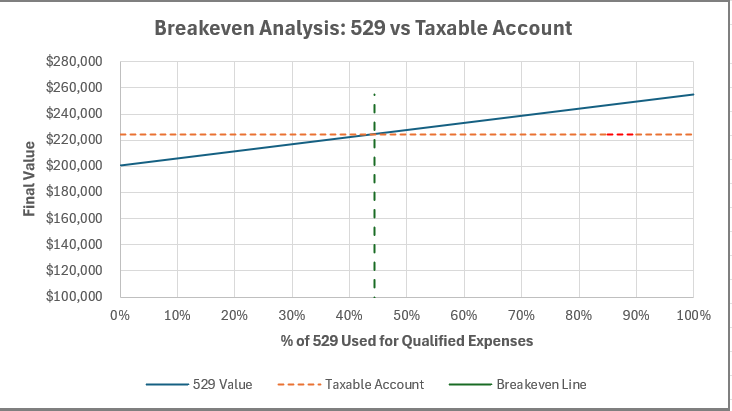

It is a valid question, and I set out to answer it using math. I created an Excel calculator where you can input the variables applicable to your situation including years until college, annual savings amount (invested at the beginning of each year), expected growth rate on your investments, your state income tax, your federal income tax, your capital gains tax. You can change the percentage of the 529 account used and it will calculate the final value of the 529 after taxes and penalties. It will compare it to the same investment in a taxable account and even generates a graph that shows you the break-even point. It is a handy tool, and you can download it directly for your own use from the financial tools page on my website here. Below is an example of the graph in one scenario.

What does the calculator say is the answer to the question? It depends. It depends on the variables unique to your situation and how much of the 529 plan gets used. But it is reassuring that in almost all situations, as long as you use around 40% of your 529 money, you come out ahead, even with the extra tax and penalty.

This outcome also doesn’t account for a few other important options with unspent 529s:

The SECURE ACT 2.0 created a provision that allows you to transfer up to $35k into a Roth IRA for the beneficiary as long as the account has been open for at least 15 years. (Can only transfer the yearly Roth IRA limit at a time).

The penalty (but not the tax) is waived if the beneficiary gets a scholarship, attends a military college, becomes disabled or dies.

You can change beneficiaries to another family member at any time.

Bottom line, although it is always good planning to not put more money into a 529 than you think that your beneficiary is likely to use to get through their education, as long as they attend some post-secondary school or you have other beneficiaries who could use the funds, you should feel safe that you are likely to come out ahead using a 529 for college savings.

Reach out if you would like to learn more about becoming a client. You can set up a free discovery call on my calendar using this link.

Disclaimer: the material in this blog post is intended for general educational purposes only and should not be considered specific financial advice. You should always consult with your personal financial advisor to see how it might fit within your personalized financial plan.

Comments