top of page

Financial Grand Rounds

with Bryan Jepson, MD, CFP®

All Posts

Sequence Risk Isn’t Just About Retirement — It’s About Career Transitions

Why leaving clinical medicine can amplify volatility — even if your math works. Sequence risk is typically framed as a retirement math problem. But it’s often a life-timing problem. The real danger isn’t just poor early returns — it’s when volatility collides with income reduction and identity shifts. Anyone familiar with me from my website, blog articles or podcast appearances knows that I am a second shifter. "The Second Shift" is the name of a new podcast that I am co-ho

bryanjepson

3 days ago8 min read

Donor Advised Funds Explained: A Practical Guide to Tax-Efficient Charitable Giving

Donor Advised Funds: A smart tax strategy In my last post , I spoke about a great tax strategy for charitable giving called a Qualified Charitable Distribution , or QCD. QCDs allow you to lower your Adjusted Gross Income (AGI) dollar for dollar and still take advantage of the standard deduction (or itemize if it makes sense) for further reduction of your tax bill. The main problem with the QCD strategy is that it is available to a relatively small demographic: charitably

bryanjepson

Jan 307 min read

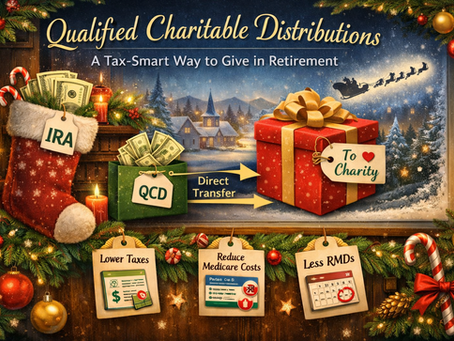

Qualified Charitable Distributions: One of the Most Overlooked Tax Strategies in Retirement

This week is Christmas, which feels like the perfect time to write a post about charitable giving. I recently worked with a retired client couple who were excellent candidates for a Qualified Charitable Distribution (QCD): are charitably minded, still have relatively high income (pension/social security/part-time employment), are required to take RMDs, and hold a meaningful balance in a traditional IRA. I introduced the concept to them and was able to save them thousands of d

bryanjepson

Dec 27, 20255 min read

Asset Location After You Retire: What Changes and Why It Matters

When most of us think about saving for retirement, we often start with a net worth goal—a number generated perhaps by a formula like the 4% rule or financial planning software. Once we hit that number, we figure, the work will be done. So, we put our heads down and earn, save, and invest diligently to achieve our retirement goal. These working years can also be called life’s accumulation phase. Well, the reality is that life doesn’t stop at retirement, and neither do th

bryanjepson

Dec 17, 20257 min read

What is one of the most overlooked investment strategies? Asset location

When most people think about “investment strategy,” they immediately jump to asset allocation —the mix of stocks, bonds, and alternative investments that matches their risk tolerance and time horizon. But there’s a second, equally important concept that rarely gets discussed outside of professional planning circles: Asset location. If asset allocation is what you invest in, asset location is where you place those investments. And getting this right can add tens of thousand

bryanjepson

Nov 26, 20257 min read

Winning the distribution phase: How to efficiently access your money when you retire

You’ve worked hard your entire career and made the right financial decisions to build a solid nest egg and to be positioned to retire on your own terms. But the accumulation phase in life is only half of the story. Now you have to start distributing and living off your assets. First, are you ready for that shift in mindset? It turns out that it is harder than you think. Second, do you know how to access your money in a logical and tax-efficient manner? These are common qu

bryanjepson

Nov 19, 20258 min read

What are Roth conversions—and how can they save you millions

One of the most powerful tools in the financial planning toolbelt in terms of tax strategy is called a Roth conversion. It is simply moving money from your pre-tax retirement accounts to your tax-free (or Roth) retirement accounts after you have stopped working and when you are in a lower income tax bracket. Let’s review how it works. Nest-egg buckets As you save, invest, and grow your retirement nest egg, there are three possible destinations, or buckets, where those asset

bryanjepson

Oct 23, 20258 min read

DIY vs. Using a Financial Advisor: How to Decide What’s Right for You

I’ve been a DIY investor for nearly three decades, and a financial advisor for almost three years. I’ve always enjoyed learning about investing and managing my own finances and, honestly, never seriously considered hiring a financial advisor before I became one myself. So why the career pivot? After many years in emergency medicine, I wasn’t mentally ready to retire — but I was ready for something different. I decided to dig deeper into my passions and see where that led. For

bryanjepson

Oct 11, 20256 min read

Are you confused about how bonds are priced? You’re not alone. Here’s how it works

In my last article , I talked about the basic types and terminologies of bonds. We learned about terms like coupon rates, par values, and maturities. The thing that used to confuse me most about bonds is their pricing. I would hear on the news that interest rates were up, and bond prices were falling. That didn’t really make sense to me. Wouldn’t higher interest rates make bonds more attractive? Actually, it’s the opposite. Today, I’ll explain how it all works. The tw

bryanjepson

Oct 2, 20256 min read

You likely have bonds in your portfolio. But do you understand how they work?

I was aware of bonds early in my investing career but will admit that I didn’t really know that much about them or how they actually worked until I took a basic financial management course as part of my master’s program in finance. I just knew that they paid out interest, were less volatile, and had lower growth potential than stocks. I was comfortable with the risk of the stock market and wanted the growth, so I didn’t have much interest in bonds and had very few in my por

bryanjepson

Sep 26, 20258 min read

Evaluating the bonds in your portfolio: Are they doing what you think they’re doing?

We all know that we need to invest to achieve our long-term financial goals, right? But are we confident in knowing how to invest? My last several blog posts have been about making smart decisions with your portfolio that will help you maximize your return, minimize fees, and manage your risk. Today, I’m going to talk about bonds—not the nuts and bolts of how they work, but how to decide if your selections are meeting your goals. Stocks or bonds? When we think about portfol

bryanjepson

Sep 5, 20256 min read

Investment Alpha and Beta Explained: How to Measure Portfolio Risk and Performance

In my last article, I pulled back the curtain on expense ratios —those “silent fees” that can drag down your portfolio without you noticing. But keeping costs low is only the first step in smart portfolio management . The next question is: how do you actually measure whether your portfolio is performing well? That’s where alpha and beta come in. These two simple metrics can show you not just how much you earned, but how much risk you took to get there. Passive vs Active Inv

bryanjepson

Aug 18, 20255 min read

Are Fees Eating Your Returns? What Every Investor Should Know About Mutual Fund Costs

As a financial planner, I review a lot of investment portfolios and have learned a few things by doing so. There are some common mistakes eating into portfolio returns that investors are unaware of or have just overlooked. Over my next few posts, I am going to discuss some ways that we can all be a little more careful with our portfolio selections. Today’s post is about paying attention to hidden fees, namely mutual fund expense ratios and sales loads. First, why do I refe

bryanjepson

Aug 6, 20256 min read

Do you know your net worth? Projecting it out can keep your financial goals on track.

Every quarter, public companies are required to report their finances to shareholders ad potential investors. These reports can significantly alter stock prices and company value if anything defies expectations, even slightly. The core of the financial report is a balance sheet, an income statement, and a statement of cash flows and then there are a lot of pages of explanations and projections. With personal finance, also, it is a good idea for you to generate similar fina

bryanjepson

Jul 21, 20254 min read

Budgeting is not a dirty word! Knowing what is coming and going is the key to your financial success.

I grew up in a household where making ends meet was always a struggle. When I look back on it, I am amazed at how my parents did it with their low income and five children to feed and clothe. We didn’t have much extra compared to many of my peers, but I never felt significantly deprived. The only way that could have happened is that my parents were really good at budgeting. And they still are! Now in their mid-80’s, they still live below their means even though their only s

bryanjepson

Jul 12, 20255 min read

Worried about overfunding a 529? Would a taxable account be better for college savings? I built a calculator to help you decide.

My last few blog posts have been all about saving for the rising cost of college education. First was a post about how to figure out how much you will need to save. The second post was about the various savings options. This post is a little bit different and will try to address the question: What happens if I have saved all this money in a 529 account and my child doesn’t end up using it? As a quick review, a 529 account is a state-administered college savings account wh

bryanjepson

Jul 4, 20253 min read

Saving for college: 529 plans and beyond

Having reaped the reward from investing in higher education, it is natural for physicians to hope for the same for their children. But the cost of that education continues to climb and climb. If we can make that road a little easier for our kids, we do it. In my last blog, I introduced a college education savings calculator that is available in the "financial tools" page on my website. This is an easy-to-use tool to figure out how much you need to save for your kids. Tod

bryanjepson

Jun 29, 20258 min read

Are you saving for kids to go to college? Check out my new savings calculator that does all the math.

Saving for higher education As people who understand firsthand the financial power of higher education, most physicians encourage their children to follow in their footsteps, at least to the level of a college degree. But that degree comes with a significant cost—an ever increasing one. If you are in the stage of life where you are saving for kids to go to college, looking years ahead to the cost of attendance can be jaw-dropping. If you don’t start early with a solid inve

bryanjepson

Jun 18, 20253 min read

The Investor Behavior Gap: Are your DIY behaviors hurting your returns, and is it worth paying an advisor to overcome them?

Behavior Gap: difference between expected and actual investor outcome I recently got an email from a fellow physician finance enthusiast/professional, Dr. Kenneth Kim. Kenny is a physician, an enrolled agent (EA), a professional tax strategist, and a blogger who does a great job teaching other doctors about taxes. I encourage you to check out his blog here . Anyway, he sent me a couple of interesting articles comparing the investment returns of the two major types of reti

bryanjepson

Jun 4, 20255 min read

Anchoring Bias: How the First Number You Hear Skews Financial Decisions

Doctor dragged down by anchoring bias Have you ever noticed how the first number you hear tends to shape everything that comes after it—whether it’s the price of a house, a job offer, or even your retirement target? That’s not just a quirk of human thinking; it’s a well-documented psychological phenomenon called anchoring bias. It affects our financial decisions more than we realize—quietly influencing what we think something should be worth, what we feel we deserve to earn

bryanjepson

May 25, 20255 min read

Disclaimer: The content in this blog is for educational purposes only and should not be considered financial advice. You should always consult with your own financial advisor to see how any of it would fit into your personal financial plan.

bottom of page